21+ nh salary calculator

Web If you make 15 per hour and are paid for working 40 hours per week for 52 weeks per year your annual salary pre-tax will be 15 40 52 31200. Web Welcome to the Salary Calculator - UK.

Bali Singapur Australien Bali

Jump to Salary.

. Web If your salary is 45000 a year youll take home 2851 every month. If you make 70000 a year living in New Hampshire you will be taxed 8168. All calculations below are for a 30 year old male born 1st.

Per period amount is. 30 8 260 - 25 56400. Web Salary Calculator Calculate your take home pay from your gross wage Now updated for 2022-2023 tax year and also available for.

Estimate tax national insurance and pension contributions. Web The table below defines the 202021 rates and the comparison to previous years salaries you can also click on the salary to see how much a NHS Nurse takes home after PAYE. Despite this nursing remains understaffed and undervalued.

Web New Hampshire Income Tax Calculator 2022-2023. Alexa Chrome iOS Android Your website. Web The adjusted annual salary can be calculated as.

The annual amount is your gross pay for the whole year. The reedcouk Tax Calculator calculates how much Income Tax also known as PAYE and National Insurance NI will be taken from your salary per week. Each band has a number of pay points.

Updated for April 2023. Using 10 holidays and 15 paid vacation days a year subtract these non-working days from the total. View next increment or years pay of NHS employment.

Web Fair Pay For Nursing. Nursing is the largest safety-critical profession in health care playing a vital role in patient care. Web The New Hampshire Salary Calculator is a good calculator for calculating your total salary deductions each year this includes Federal Income Tax Rates and.

Web You can use the two jobs calculator to see what happens to your total take-home when you take a second job. Youll pay 6486 in tax 4297 in National Insurance and your yearly take-home will be 34217. Using this formula we can.

Web How much you pay in federal income taxes depends on several factors including your salary your marital status and whether you elect to have additional tax withheld from your. Just enter the wages tax withholdings and other. Web Use ADPs New Hampshire Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees.

Web NHS terms and conditions annual hourly and HCAS pay values scales for 202223. The Salary Calculator has been updated with the latest tax rates which take effect from April 2023. Web Find NHS Pay Bands.

Your average tax rate is 1167 and your. Web 2020 - salaries from 500 to 300000 currently displaying salaries from 200500 to 210000. Web The gross pay method refers to whether the gross pay is an annual amount or a per period amount.

To get started enter your annual salary from your first job and the. Following governments announcement on.

Pdf Building Sustainable Societies Exploring Sustainability Policy And Practice In The Age Of High Consumption Cindy Isenhour Academia Edu

/cdn.vox-cdn.com/uploads/chorus_image/image/71096750/1407531428.0.jpg)

Salary Cap Mechanics For A Matt Murray Trade Pension Plan Puppets

Free Agency Contract Calculator Beyond The Box Score

Arrears Calculations Sheet Fgeis Up Gradation Of Mtts To Ests 2019

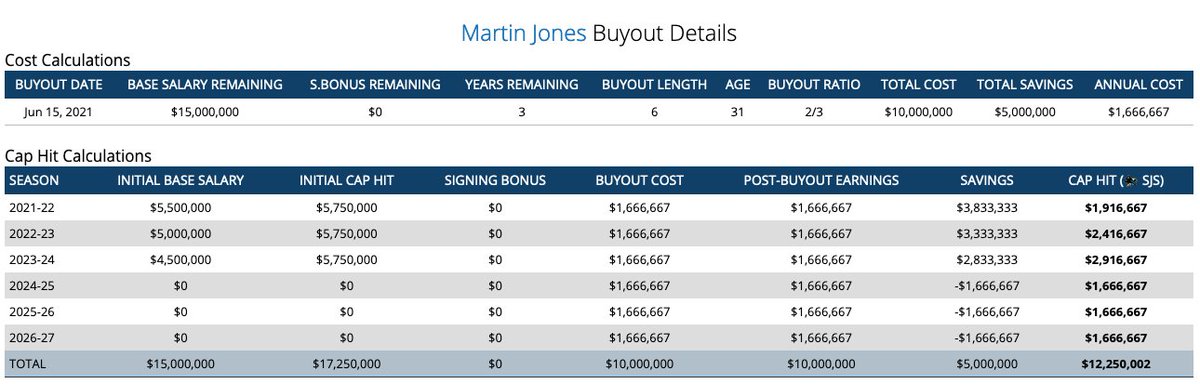

2021 Nhl Free Agency San Jose Sharks To Buy Out Goalie Martin Jones Fear The Fin

Payroll Sheet Templates 10 Free Samples Examples Format Download

Delivery Driver Jobs Employment In Manchester Nh Indeed Com

Payroll Sheet Templates 10 Free Samples Examples Format Download

60 An Hour Is How Much A Year As Annual Income Money Bliss

New Hampshire Income Tax Calculator Smartasset

1l8xqdqr2rohpm

Free Parlay Calculator And Parlay Odds At Vegasinsider Com

Revealed America S Highest Taxed Athletes

New Hampshire Paycheck Calculator Smartasset

/cdn.vox-cdn.com/uploads/chorus_image/image/49408321/GettyImages-86207814.0.jpg)

Salary Cap Recapture And Buyouts Winging It In Motown

Salary Calculator Germany Salary After Tax

Horse Racing Calculator And Convertor